For traders, it’s important to know how to calculate profit and loss before placing an order. Here’s a guide to help you better understand the relationship between different variables and profit & loss calculations.

Please note that Bybit supports USDT Options, and the P&L will be settled in USDT.

Average Entry Price

When traders place new orders for the existing Options contract, the entry price will change accordingly.

Formula

Position Average Price = [(Last Position Quantity × Last Position Average Price) + (Traded Quantity × Traded Price)]/(Last Position Quantity + Traded Quantity)

Example

Ann holds a 0.1 BTC of BTCUSDT-31DEC21-48000-C, with an entry price of $3,500. She believes that the price of BTC will continue to rise in the near future. Ann decides to increase her call options, and opens a new call option of 0.1 BTC at the entry price of $4,000.

Average Entry Price = [(0.1 × 3,500) + (0.1 × 4,000)]/(0.1 + 0.1) = $3,750

Unrealized P&L

Unrealized P&L (UPL) is the current profit or loss of open positions. Based on the direction of your position — long or short — the formula used to calculate the unrealized profit and loss will be different.

ROI

ROI shows the percentage return on investment for each position.

Closed P&L

Closed P&L is the profit and loss that occurs when the trader closes the position.

Formula

Closed P&L for Buy Call/ Put = (Traded Price − Position Average Price) × Traded Quantity − Trading Fees (open and closed position)

Closed P&L for Sell Call/ Put = (Position Average Price − Traded Price) × Traded Quantity − Trading Fees (open and closed position)

Example

Sell Call: The BTC index price is $44,900. Bob sells a 0.3 of BTC BTCUSDT-31DEC21-50000-C, with an average entry price of $2,600. When the price of BTC drops to $44,000, he closes the position early at a mark price of $2,400.

The Closed P&L of the option is 52 USDT, based on the following calculation:

[(2,600 − 2,400) × 0.3] − 44,900 × 0.3 × 0.03% − 44,000 × 0.3 × 0.03%.

Delivery P&L

This is generated when the Option expires.

Formula

Delivered RPL for Call Option = Maximum (Delivery Price − Strike Price, 0) × Position Quantity + Premium (receive or pay) − Delivery Fee − Trading Fee (open position)

Delivered RPL for Put Option = Maximum (Strike Price − Delivery Price, 0) × Position Quantity + Premium (receive or pay) − Delivery Fee − Trading Fee (open position)

Example

Buy Call:

The BTC index price is $44,900. Ann buys a 0.1 of BTC BTCUSDT-31DEC21-48000-C, with an entry price of $3,500. When the contract expires, the BTC delivery price is $52,000. It’s traded at a strike price of $48,000. The delivery P&L of the option is 47.873 USDT, based on the following calculation:

Maximum (52,000 − 48,000, 0) × 0.1 − 3,500 × 0.1 − 44,900 × 0.1 × 0.03% − 52,000 × 0.1 × 0.015%

Let’s revisit Ann’s case, in which the BTC index price is $44,900. Ann holds a 0.1 of BTC BTCUSDT-31DEC21-48000-C, with an entry price of $3,500. The delivery

P&L of the option is 400 USDT.

- Trading Fee = Minimum (0.03% × 44,900, 12.5% × 3,500) × 0.1 = 1.347 USDT

Note: Trading fee for a single contract can never be higher than 12.5% of the option price.

Let’s suppose that the estimated delivery price is $49,000 when the contract is about to expire.

- Delivery Fee = Minimum [(0.015% × 49,000, 12.5% × (49,000 − 48,000)] × 0.1= 0.735 USDT

As an option buyer, Ann needs to pay a premium to the seller to obtain the right to the call option.

Formula:

Premium = Traded Quantity × Traded Price

- 0.1 × 3,500 = 350 USDT

Delivery P&L = 400 − 1.347 − 0.735 − 350 = 47.918 USDT

Closed P&L and Delivery P&L are different from Unrealized P&L and Realized P&L. It’s worth noting that Delivery P&L also takes premium into account. Please refer to the following table for details:

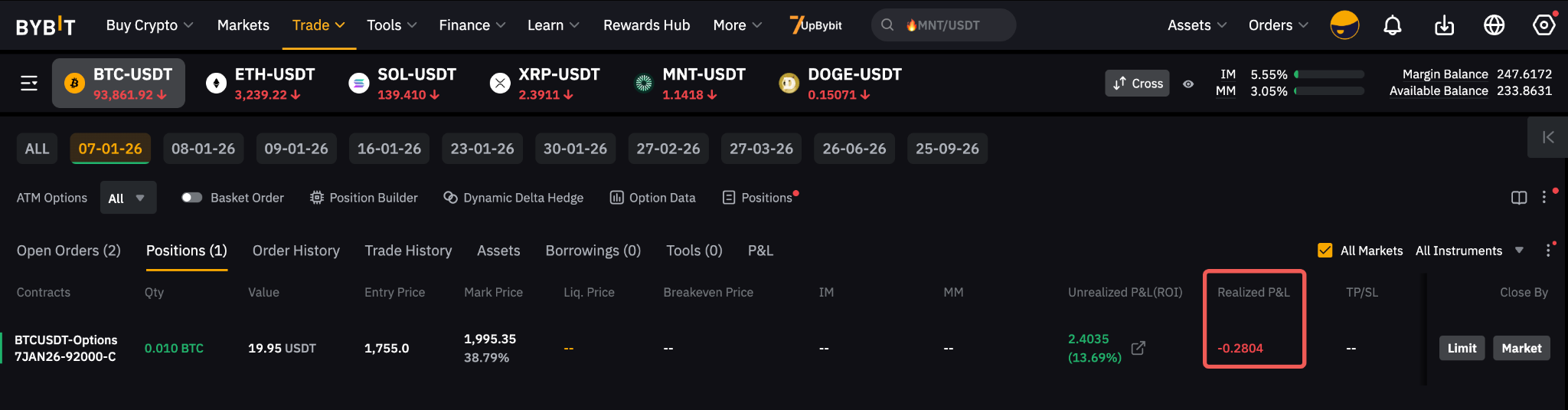

Realized P&L

Realized P&L is the profit and loss that occurs when the trader closes the position early. Please note that the Realized P&L in the position zone represents the total profit and loss of the position since the position has been held.

Formula

Realized P&L = Sum (Profit and loss on closed positions) − Trading Fees (open and closed positions)

Example

Let's see how the Realized P&L displayed in the position zone changes in different scenarios.

Scenario 1: Bob buys 0.4 of BTC BTCUSDT-31DEC21-50000-C when the Option mark price is $2,400 and the BTC index price is $44,000.

Trading Fee (open position) = 44,000 × 0.4 × 0.03% = 5.28 USDT

In this case, the Realized P&L of Bob's position is −5.28 USDT.

Scenario 2: The BTC index price rises to $44,900. Bob sells a 0.3 of BTC BTCUSDT-31DEC21-50000-C, with an average entry price of $2,400. He closes the position at a mark price of $2,600.

Realized P&L (before) = - 5.28 USDT

Trading Fee (closed position) = 44,900 × 0.3 × 0.03% = 4.041 USDT

Realized P&L = [(2,600 − 2,400) × 0.3] − 44,900 × 0.3 × 0.03% - 5.28 = 50.68 USDT

Scenario 3: Now Bob only holds 0.1 BTC of BTCUSDT-31DEC21-50000-C. Then, when the BTC index price is $45,000, he buys 0.2 BTC of BTCUSDT-31DEC21-50000-C at $2,500.

Realized P&L (before) = 50.68 USDT

Trading Fee (open position) = 45,000 × 0.2 × 0.03% = 2.7 USDT

Realized P&L (before) = 50.68 − 2.7 = 47.98 USDT

For more detailed information about option fees, please refer to Bybit Option Fees Explained.