What Are Insurance Funds?

Bybit’s insurance fund is a reserve pool that the system can use to protect traders from bearing excessive losses in Derivatives trading. When a trader’s position is liquidated, if the closing price is better than the bankruptcy price, the trader’s remaining margin will be added to the insurance fund. However, if the closing price is worse than the bankruptcy price, resulting in a total loss of the position greater than the trader’s initial margin, the loss will be covered by the insurance fund. This mechanism also decreases the possibility of Auto-Deleveraging (ADL).

How Do Insurance Funds Work?

When a position is liquidated, it will always be settled at the bankruptcy price, which is the price level where there's no initial margin left, regardless of the current market price. The balance of the insurance fund will increase or decrease depending on the difference between the final executed price and the bankruptcy price of the liquidated position.

-

When liquidations can be executed in the market at a price better than the bankruptcy price, the remaining margin will be added to the insurance fund.

-

If the final executed price is worse than the bankruptcy price, the contract losses will be covered by the insurance fund.

Example

Let’s consider a trader with a long position on BTCUSDT in isolated margin mode. The liquidation price is 65,000 USDT and the bankruptcy price is 64,000 USDT. When the mark price hits 65,000 USDT, the position will be liquidated and settled at 64,000 USDT, regardless of the current market price.

However, it's important to note that the actual execution price to close the position is based on the current market price.

If the position can be closed at a price higher than 64,000 USDT (for instance, 64,980 USDT), the surplus margin in USDT will be added to the insurance fund. Conversely, if the final execution price falls below 64,000 USDT (for example, 63,950 USDT), the insurance fund will cover the excess contract losses that exceed the initial margin.

How to View the Insurance Fund Balance

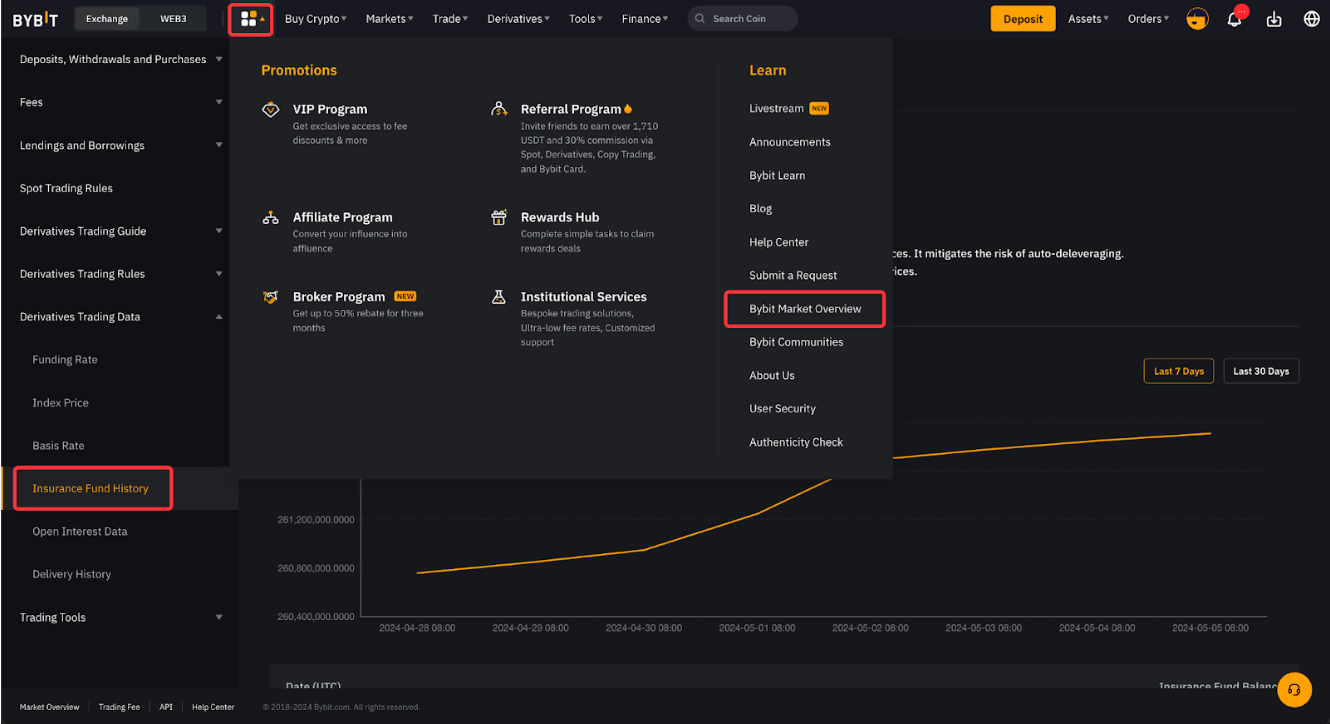

To view the balance of the Bybit’s insurance fund for all Perpetual and Futures contracts, navigate to the Bybit Market Overview and select Insurance Fund History.

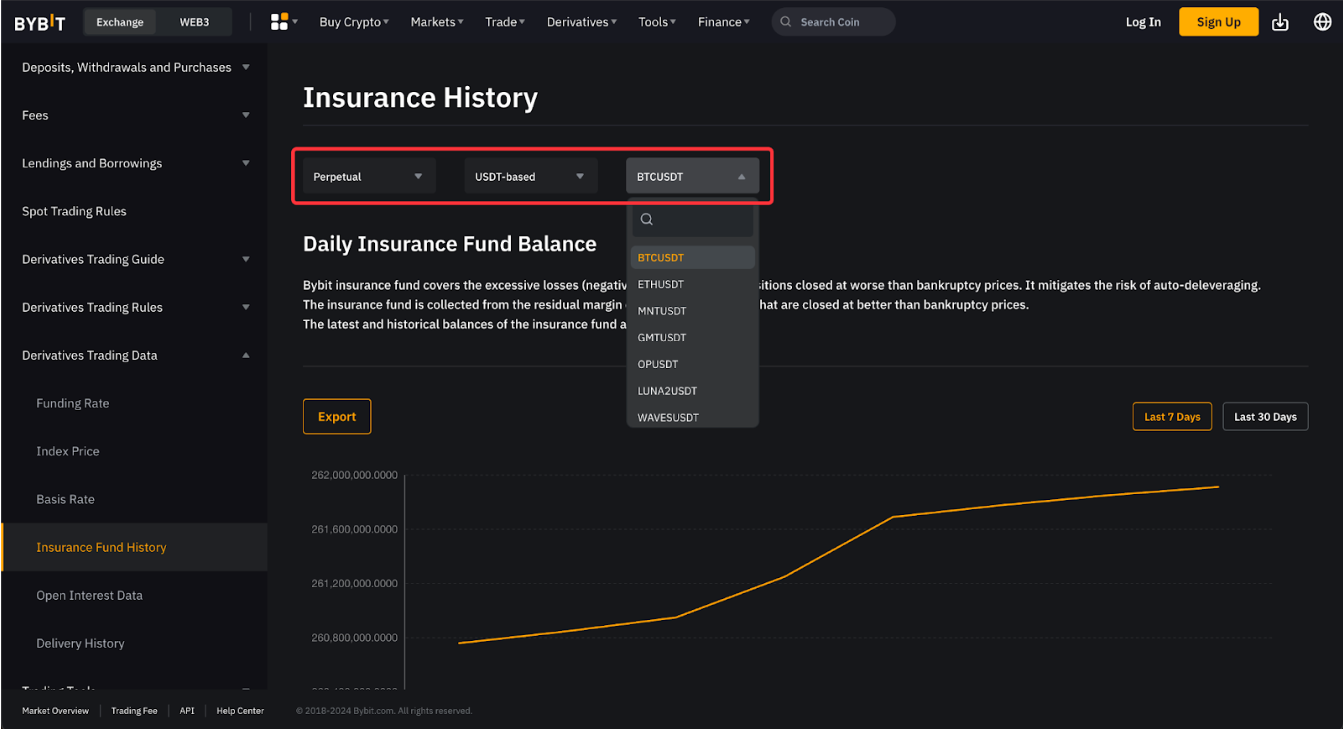

On the Insurance Fund History page, you can see the current balance of the insurance fund, which is updated daily at 12AM (midnight) UTC. It's important to note that the insurance fund pools for Inverse contracts, USDT contracts, and USDC contracts are separate from each other.

Specific to USDT Perpetual contracts, all contracts have an insurance fund denominated in USDT. However, some contracts will have a separate insurance fund pool allocated based on their specific project risk levels. You can filter the contracts you wish to view on the page.

Depleted Insurance Fund

If a significant number of positions on the platform are liquidated simultaneously, resulting in excess contract losses exceeding what the position margins can cover, the insurance fund pool could be depleted. In such cases, if the insurance fund is insufficient to cover the excess losses, they will be absorbed by the ADL system, which means the profits from other traders' positions on the platform will be used to cover the shortfall. For more details about Auto-Deleveraging, please refer to here.