On the Derivatives trading page, traders may check the funding rate, which will fluctuate in real-time until the upcoming funding timestamp. The funding rate is not fixed and is updated every minute, according to the Interest Rate and Premium Index, which affects the calculation of the funding rate until the end of the current funding interval.

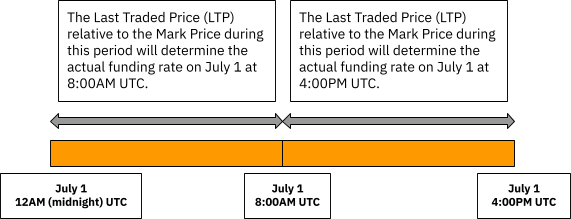

Let’s take an 8-hour funding time interval as an example.

- The funding rate is calculated between 12AM (midnight) UTC and 8AM UTC, and will be exchanged at 8AM UTC.

- Funding rates calculated between 8AM UTC and 4PM UTC will be exchanged at 4PM UTC.

Funding Rate Calculation

The funding rate consists of two parts: Interest Rate (I) and Average Premium Index (P).

Bybit calculates the Interest Rate (I) and the Average Premium Index (P) every minute by performing an N-Hour Time-Weighted-Average-Price (TWAP) over the series of minute rates. The closer to the funding fee settlement time, the greater the coefficient of the premium index.

This calculated funding rate is then applied to a trader’s position value to determine the funding fee to be paid or received at the funding timestamp.

Funding Rate (F) = clamp [Average Premium Index (P) + clamp (Interest Rate (I) − Average Premium Index (P), 0.05%, −0.05%), Funding Rate Upper Limit, Funding Rate Lower Limit]

1. Interest Rate (I)

Interest Rate (I) = 0.03% / (24 / Funding Interval)

Take BTCUSD as an example, the interest rate is fixed at 0.03% per day (0.01% per funding interval, assuming the funding charge interval is 8 hours).

Exception: For specific trading pairs (e.g., USDCUSDT or ETHBTCUSDT), the interest rate (I) will default to 0%.

2. Average Premium Index (P)

Perpetual contracts may trade at either a premium or discount from the mark price. In this situation, a premium index will be used to raise or lower the next funding rate to align with the level of the contract trade.

Tip: You can view the history of the premium index in Premium Index under the Contract Details.

Premium Index (P) = [Max (0, Impact Bid Price − Index Price) − Max (0, Index Price − Impact Ask Price)]/Index Price

- Impact Bid Price = The average fill price required to execute the Impact Margin Notional on the bid side.

- Impact Ask Price = The average fill price required to execute the Impact Margin Notional on the ask side.

Impact Margin Notional is the notion available to trade with a certain amount of margin. It’s used to determine how deep the order book is and to measure the Impact Bid or Ask Price. It is configured in USDT value and can be found here.

Average Premium Index (P)

A weighted average algorithm is used, incorporating the Premium Index values from the previous settlement period up to the current time.

Taking an 8-hour funding interval as an example, the Average Premium Index (P) is calculated using the formula: (Premium Index _1 * 1 + Premium Index _2 * 2 +... + Premium Index _480 * 480)/(1 + 2 +... + 480).

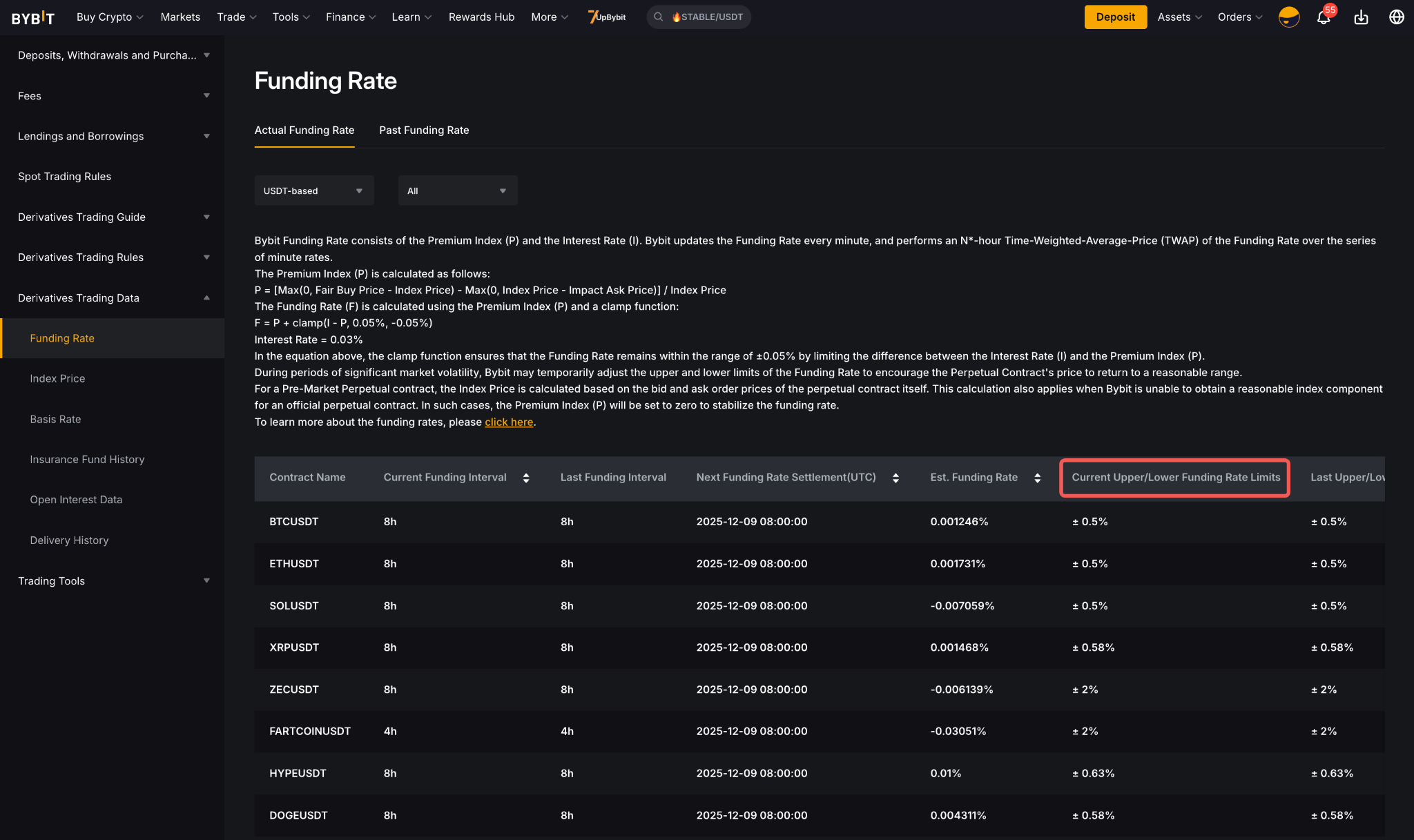

3. Funding Rate Upper and Lower Limit

During periods of significant market volatility, Bybit may temporarily adjust the upper and lower limits of the Funding Rate to encourage the Perpetual Contract's price to return to a reasonable range.

Under normal circumstances,

- Funding Rate Upper Limit = min((Initial Margin Rate - Maintenance Margin Rate) x 0.75, Maintenance Margin Rate)

- Funding Rate Lower Limit = -min((Initial Margin Rate - Maintenance Margin Rate) x 0.75, Maintenance Margin Rate)

Where IMR and MMR represent the initial margin rate and maintenance margin rate requirements of the lowest risk limit tier for each symbol.

Note: when there is a significant price difference between the futures market and the spot market, we will adjust the coefficient of 0.75, within a range from 0.5 to 1.

To view the updated Funding Rate Limit, please visit here.

Funding Rate for Pre-Market Perpetual

The funding rate calculation method for pre-market perpetual contracts is divided into two scenarios:

- During the call auction period, the funding rate is set to zero “0”, and the Premium Index and Interest Rate do not participate in the funding fee calculation.

- During the continuous auction period, the funding rate is fixed at 0.005% and is settled every 4 hours.